Some Known Factual Statements About Home Insurance

Wiki Article

Some Of Car Insurance

Table of ContentsSome Known Details About Car Insurance The Best Guide To Cheap Car InsuranceNot known Details About Cheap Car Insurance The Definitive Guide to Travel Insurance

You Might Want Handicap Insurance Policy Too "As opposed to what lots of people think, their house or car is not their greatest possession. Instead, it is their capability to gain an income. Yet, several experts do not insure the possibility of a handicap," said John Barnes, CFP and also owner of My Domesticity Insurance, in an e-mail to The Equilibrium.

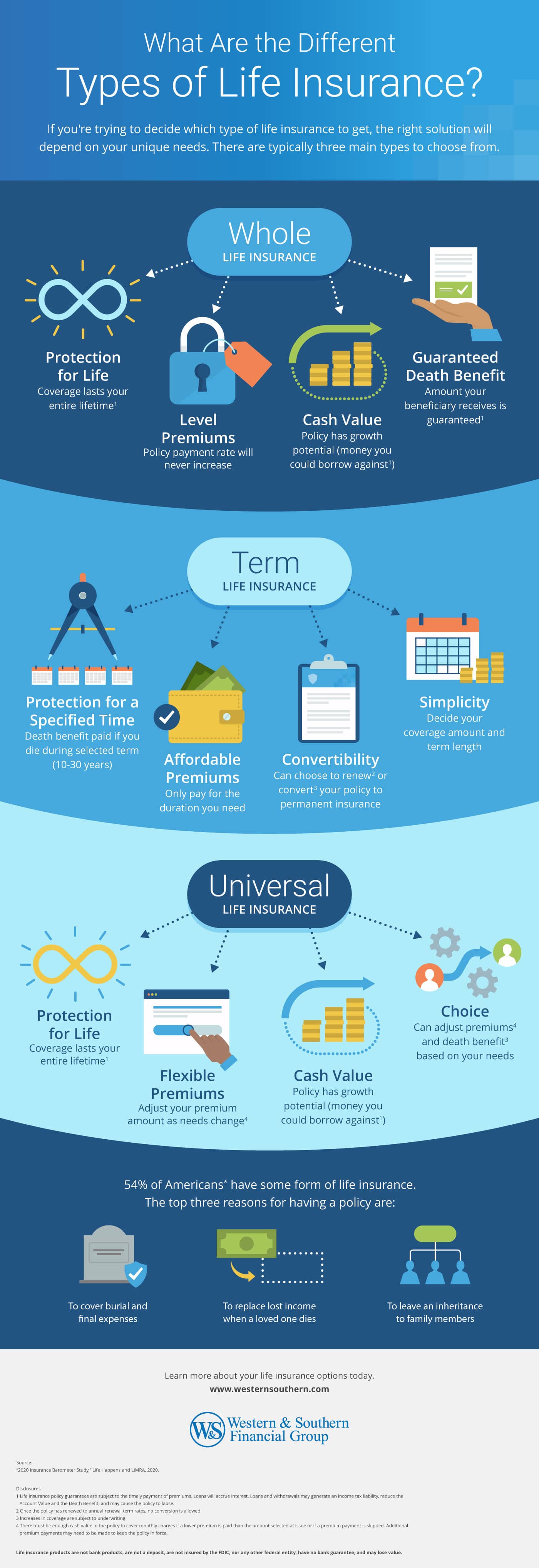

The information listed below concentrates on life insurance policy sold to people. Term Term Insurance coverage is the simplest kind of life insurance policy. It pays only if fatality happens throughout the term of the plan, which is typically from one to 30 years. The majority of term policies have nothing else benefit provisions. There are two standard types of term life insurance policy policies: degree term as well as reducing term.

The cost per $1,000 of benefit rises as the guaranteed individual ages, and also it undoubtedly gets very high when the guaranteed lives to 80 and past. The insurance policy company might bill a costs that enhances yearly, however that would make it extremely hard for the majority of people to manage life insurance coverage at innovative ages.

Car Insurance Quotes for Beginners

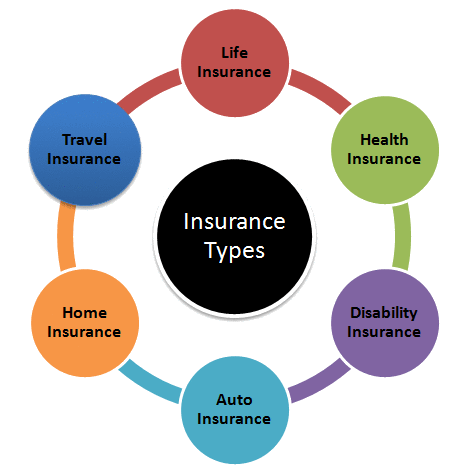

Insurance coverage plans are created on the concept that although we can not quit unfavorable occasions happening, we can safeguard ourselves financially against them. There are a huge number of different insurance plan readily available on the market, as well as all insurance companies attempt to convince us of the benefits of their particular product. A lot so that it can be difficult to choose which insurance coverage policies are really essential, and which ones we can reasonably live without.Researchers have located that if the key wage income earner were to die their household would just have the ability to cover their home costs for just a couple of months; one in 4 family members would have issues covering their outgoings quickly. The majority of insurance providers suggest that you get cover for around ten times your annual income - car insurance quotes.

You must likewise consider childcare expenditures, and future university costs if suitable. There are 2 major types of life insurance policy policy to choose from: entire life plans, as well as term life policies. You pay for entire life plans till you die, as well as you pay for term life policies for a description set time period figured out when you get the policy.

Health Insurance policy, Wellness insurance is another one of the 4 main kinds of insurance coverage that professionals recommend. A recent study exposed that sixty two percent of individual insolvencies in the United States in 2007 were as a straight result of health issue. A shocking seventy 8 percent of these filers had medical insurance when their health problem began.

Fascination About Medicaid

Costs vary considerably according to your age, your existing state of health, as well as your way of living. Also if it is not a legal demand to take out vehicle insurance policy where you live it is highly suggested that you have some kind of plan in place as you will still have to presume economic responsibility in the case of a mishap.Additionally, your vehicle is usually one of your most useful assets, as well as if it is damaged in a mishap you might struggle to spend for repair services, or for a replacement. You might also discover yourself responsible for injuries suffered by your guests, or the driver of one more car, use this link as well as for damage caused to another vehicle as an outcome of your negligence.

General insurance policy covers home, your travel, automobile, and wellness (non-life assets) from fire, floodings, mishaps, synthetic catastrophes, as well as theft. Various kinds of general insurance coverage include motor insurance, wellness insurance policy, traveling insurance policy, as well as home insurance. A basic insurance coverage pays for the losses that are sustained by the guaranteed during the duration of the plan.

Continue reading to know even more concerning them: As the home is a beneficial possession, it is essential to safeguard your house with a proper. Residence as well as family insurance safeguard your home as well as the items in it. More Help A house insurance policy basically covers manufactured and natural situations that may result in damages or loss.

A Biased View of Life Insurance

It can be found in 2 kinds, third-party as well as detailed. When your car is in charge of an accident, third-party insurance coverage takes care of the injury triggered to a third-party. You must take into account one truth that it does not cover any of your automobile's damages. It is additionally vital to keep in mind that third-party motor insurance is necessary as per the Electric Motor Cars Act, 1988.

A a hospital stay expenses approximately the sum guaranteed. When it concerns medical insurance, one can choose for a standalone wellness policy or a family members advance plan that uses protection for all household participants. Life insurance supplies insurance coverage for your life. If a situation happens in which the insurance policy holder has a sudden death within the term of the plan, then the nominee obtains the amount assured by the insurance policy company.

Life insurance is different from general insurance policy on numerous parameters: is a short-term contract whereas life insurance policy is a lasting agreement. When it comes to life insurance coverage, the advantages as well as the sum guaranteed is paid on the maturation of the plan or in the occasion of the plan owner's fatality.

They are nonetheless not necessary to have. The general insurance coverage cover that is obligatory is third-party obligation vehicle insurance coverage. This is the minimal insurance coverage that an automobile must have prior to they can layer on Indian roads. Every type of basic insurance policy cover features a purpose, to use insurance coverage for a specific element.

Report this wiki page